The Equation Best Describing the Income Statement Is

Assets - Liabilities Stockholders Equity B. A ability of the enterprise to pay currently maturing obligations.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Income Statement Definition Uses Examples

Owners equity Assets - Liabilities.

. Assets Liabilities Stockholders Equity D. The equation best describing the income statement is. Assets - Liabilities Stockholders Equity.

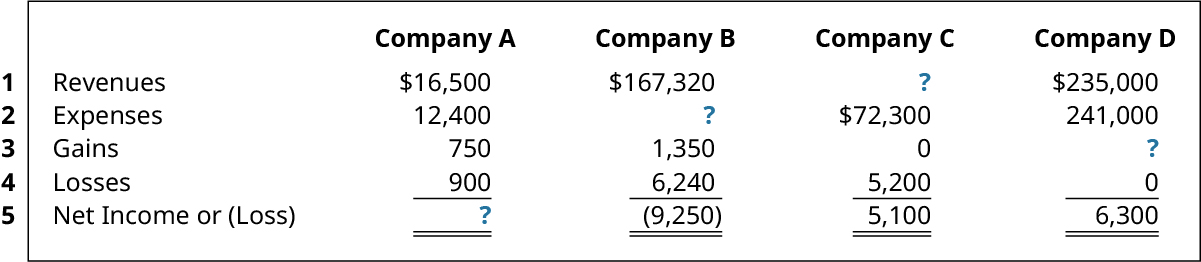

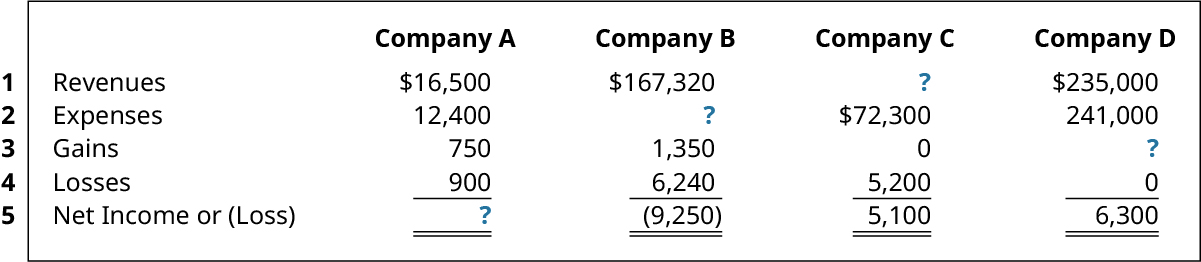

Income Statement Formula is represented as Gross Profit Revenues Cost of Goods Sold Operating Income Gross Profit Operating Expenses Net income Operating Income Non. 247 help from Expert Tutors on 140 subjects. 2010 revenues were 99000.

Revenues - Expenses Net Income. Operating Profit Margin Operating Profit Sales 100 Operating profit Earnings before Interest Tax EBIT Sales COGS Operating expenses 3. Revenues Expenses Net Income.

Revenues Expenses Income. Revenue - expense net income Expl. B ability of the enterprise to meet.

Get more out of your subscription Access to over 100 million course-specific study resources. Full access to over 1 million Textbook Solutions. Heres information on each of the four different income statement components.

Gross profit deducts taxes while net income does not. Which of the following equations best describes the income statement. Net income Revenues Expenses.

Which of the following equations best describes the income statement. Net income Revenues - Expenses. The flip side of gains such as.

Net income Revenues Expenses C. Income from non-business-related transactions such as selling a company asset. Net income Revenues - Expenses.

The profit or loss is determined by taking all. Which statement below best describes the accounting equation. Assets - Liabilities Stockholders equity Net income Revenue Expenses Net income Revenue - Expenses Retained Net income dividends.

Retained earnings Net Income Dividends. Assets Revenues - Expenses C. This can be calculated by subtracting the expenses to the total revenues.

The change in retained earnings equals net income less dividends. Net Profit Margin Net Profit Sales 100. Resources of the company equal creditors and owners claims to those resources D.

Retained earnings Net Income Dividends C. The owners equity represents assets belonging to the owner or shareholders. It is the level if income earned by an enterprise through the efficient and effective utilization of resourcesa financial position c positive cash flows b performance d negative cash flows.

The equation best describing the income statement is. The equation best describing the income statement is Revenues -. Assets Liabilities Stockholders Equity D.

Revenues - Expenses Net Income. Net income revenue - expenses when would a company report a net loss on the income statement. It also analyzes all expenses and indicates the total cost incurred by the business.

Lena Company has provided the following data ignore income taxes. Gross profit considers operating expenses while net income does not. Assets Revenues - Expenses.

The change in retained earnings net income less dividends B. Resources of the company equal creditors and owners claims to those resources. The net income is the amount which is arrive at by subtracting total expense from revenue.

Assets Liabilities Owners Capital - Owners Drawings Revenues - Expenses. The income statement summarizes business revenue and shows the net income. Net income Revenues - Expenses.

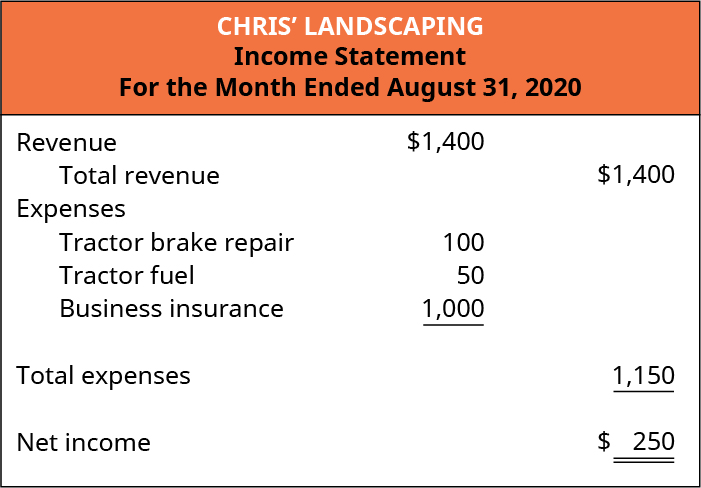

Income statement is a financial statement that shows how profitable a business is over a given reporting period. Gross Profit Margin Gross Profit Sales 100 Gross Profit Sales COGS 2. Net income Revenues - Expenses.

Retained earnings Net Income Dividends. Financing activities equal investing and operating activities. 2016 revenues were 99000.

Net income deducts taxes while. Net income Revenues - Expenses. Variation On Basic Income Statement While all income statements follow the same format some include various measures of income within the body of the statement.

Liquidity is defined as the. 1Which of the following equations best describes the income statement. Equality of revenue and expense transactions over time.

Formulas for Income Statement. The basic equation for the income statement can be written that total revenues minus total expenses equal net income. Which of the following statements best describes the difference between net income and gross profit.

Equality of revenue and expense transactions over time C. Net income considers operating expenses while gross profit does not. Net income Revenues Expenses.

Net income Revenues - Expenses. Income statement may be stated as the statement which shows the net income earned during the year. Net income Revenues Expenses C.

Revenues Expenses Income B. All income statements follow this basic format. Revenues Expenses Net Income.

Financing activities equal investing and operating activities. The accounting equation can be rearranged into three different ways. Which statement below best describes the accounting equation.

The Income Statement is one of a companys core financial statements that shows their profit and loss Profit and Loss Statement PL A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a over a period of time. Liabilities are obligations to creditors such as invoices loans taxes. Gross receipts earned by the company selling its goods or services.

View the full answer. 2Lena Company has provided the following data ignore income taxes. Which of the following equations best describes the income statement.

Retained earnings Net Income Dividends. The costs to the company to earn the gross receipts. The equation best describing the income statement is.

The last section of an income statement states if the business made a profit or a loss. Equation Best Describing the Income Statement Is Pe_GerardoMooney64 April 18 2022 Personal Financial Literacy Define Taxes Task Cards Teks 5 10a Personal Financial Literacy Financial Literacy Task Cards Run Chart Templates 7 Free Printable Docs Xlsx Docs Pdf Run Chart Templates Excel Templates Income Statement Definition Uses Examples. Assets Liabilities Stockholders Equity.

Usually a business prepares income statement at the end of every quarter and the end of the year.

Income Statement Definition Explanation And Examples

Describe The Income Statement Statement Of Owner S Equity Balance Sheet And Statement Of Cash Flows And How They Interrelate Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

Income Statement Definition Uses Examples

Describe The Income Statement Statement Of Owner S Equity Balance Sheet And Statement Of Cash Flows And How They Interrelate Principles Of Accounting Volume 1 Financial Accounting

No comments for "The Equation Best Describing the Income Statement Is"

Post a Comment